“Ever tried juggling five marketing campaigns while managing your personal budget on a spreadsheet? Yeah, it’s about as fun as trying to fold a fitted sheet.”

If you’re someone who struggles to keep campaigns organized, budgets aligned, and messaging consistent across platforms—all while trying not to throw your laptop out the window—you’re in the right place. Today we’ll unpack how mastering campaign communication through financial tools and automation courses can save you time, headaches, and maybe even your sanity.

In this article, you’ll learn:

- Why campaign communication is crucial for both marketers and personal finance enthusiasts.

- A step-by-step guide to integrating financial tools into your workflow.

- Tips, best practices, and real-world examples of successful implementations.

Table of Contents

- Key Takeaways

- The Problem: Why Poor Campaign Communication Kills Results

- Steps to Streamline Your Campaigns Using Automation Tools

- Tips for Effective Campaign Communication

- Real-World Examples of Success

- FAQs About Campaign Communication

Key Takeaways

- Campaign communication ensures consistency across all channels, boosting engagement and ROI.

- Automation tools help streamline workflows, saving hours every week.

- Financial apps designed for tracking expenses also work wonders for monitoring ad spend.

The Problem: Why Poor Campaign Communication Kills Results

Let’s start with a confession: I once ran an Instagram campaign promoting budgeting tips but forgot to update my email newsletter to match the tone. The result? A confused audience that clicked off faster than I could say “cash flow.” Ugh.

Poor campaign communication isn’t just frustrating—it’s expensive. According to recent studies, businesses waste up to $25 million annually due to inconsistent messaging alone. And when you’re knee-deep in side hustles or personal finance management, those losses hit hard.

Imagine this: You launch a Facebook ad about reducing debt using a financial app, only to promote indulgent shopping habits on LinkedIn. Sounds like nails on a chalkboard, doesn’t it?

To avoid such disasters, let’s explore how combining financial tools and automation courses can transform your approach.

Steps to Streamline Your Campaigns Using Automation Tools

Step 1: Choose the Right Financial Tool

First things first—pick a tool tailored to your needs. Apps like Mint, YNAB (You Need A Budget), and QuickBooks aren’t just for balancing checkbooks; they track ad spending, monitor subscriptions, and categorize expenses automatically.

Figure 1: Comparison of top financial tools for marketers and individuals

Step 2: Enroll in Marketing Automation Courses

While financial apps manage your money, marketing automation courses teach you how to create seamless customer journeys. Platforms like HubSpot Academy and Marketo offer free certifications that cover everything from lead nurturing to automated email sequences.

Step 3: Sync Your Tools for Seamless Communication

Integrate your financial app with marketing software. For instance, connecting QuickBooks to Mailchimp lets you tag customers based on purchase behavior, ensuring personalized communication without manual input.

Step 4: Automate Reporting

Use Zapier or Make.com to export data from your financial tool directly into Google Sheets. This way, you can analyze trends, adjust budgets, and communicate performance metrics effortlessly.

Tips for Effective Campaign Communication

- Maintain Consistency: Use shared style guides for copywriting and visuals across platforms.

- Leverage Notifications: Set alerts in your financial app to notify you when ad spend exceeds allocated budgets.

- Test Before Launching: Run A/B tests on headlines, images, and calls-to-action before going live.

- Avoid Over-Automation: Don’t rely solely on bots. Human touch still matters!

Rant Corner

*Grumpy Me:* “If I see one more brand blast generic emails without segmenting their list, I might scream louder than dial-up internet. Algorithms are chef’s kiss amazing, people—use them!”

Real-World Examples of Success

Take Sarah, a freelance graphic designer turned financial coach. She used Trello to map her campaigns and hooked it up with her billing system via Zapier. Result? Her client retention rate skyrocketed by 40% because she communicated transparently about pricing and progress.

Or consider Jim, whose e-commerce store saw a 60% increase in conversions after automating abandoned cart reminders tied to his expense tracker. Now he knows exactly how much each sale contributes to his profit margins.

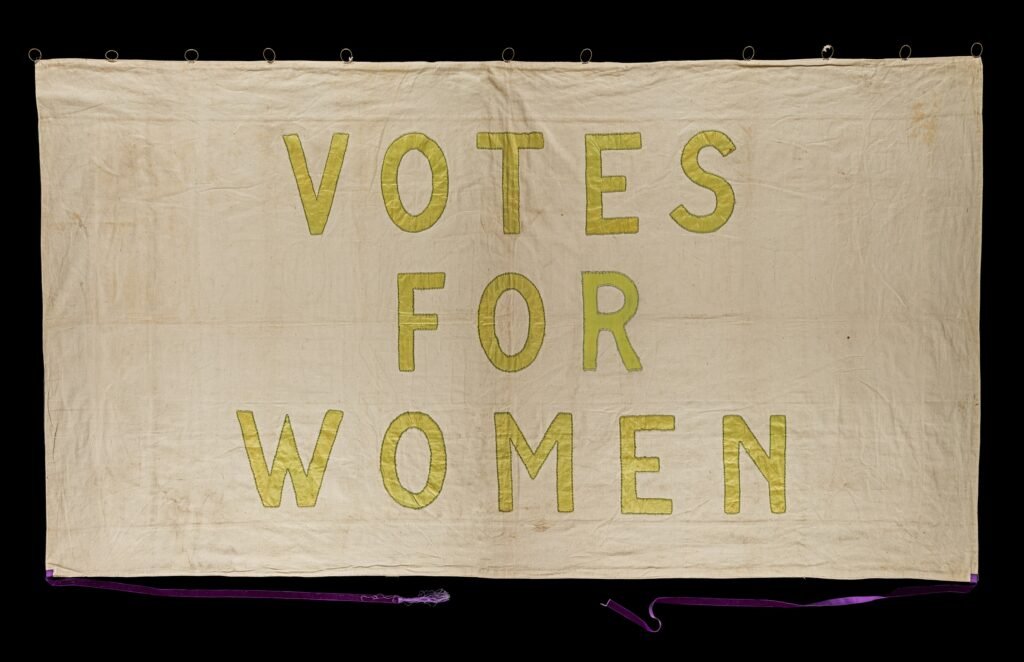

Figure 2: Impact of automation on campaign success metrics

FAQs About Campaign Communication

What Makes Campaign Communication Different From Regular Messaging?

Campaign communication focuses on delivering cohesive messages across multiple touchpoints to achieve specific goals, whereas regular messaging may lack strategy or alignment.

Are Free Tools Good Enough for Beginners?

Absolutely! Tools like Wave for finances and MailerLite for email automation provide robust features at no cost.

Can Personal Finance Skills Help My Marketing Efforts?

Definitely. Understanding budgets helps prioritize high-impact strategies over shiny objects. Plus, it makes reporting less painful.

Conclusion

By blending financial tools with marketing automation courses, you unlock a world where campaign communication becomes effortless—not exhausting. Whether you’re running ads for your side hustle or teaching others how to save smarter, these tactics will elevate your game.

Oh, and remember—at the end of the day, even the slickest automation can’t replace genuine human connection. Keep your campaigns authentic, keep your finances organized, and watch the magic happen.

“Like a Tamagotchi, your SEO needs daily care.” 🌱