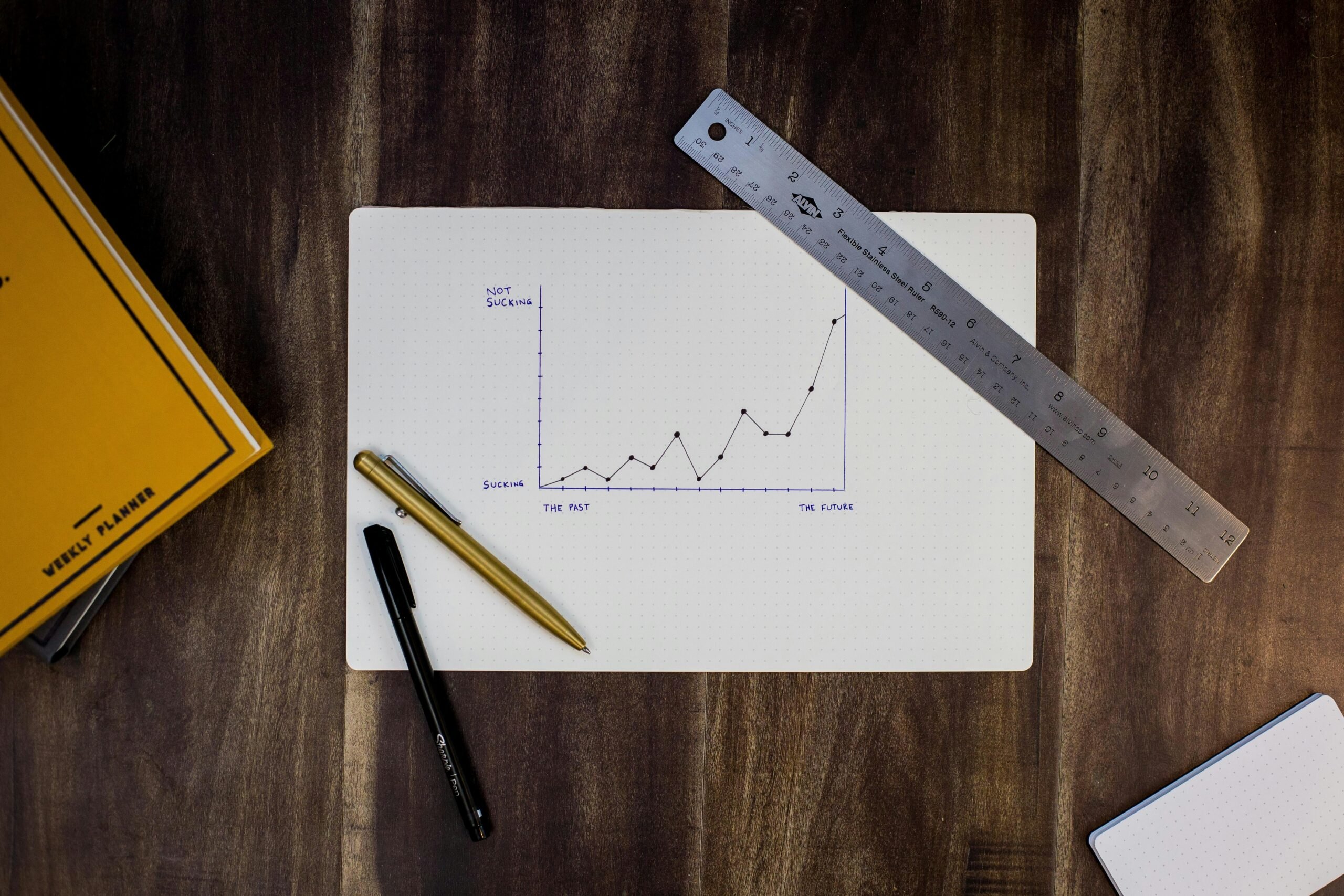

Have you ever stared at your financial dashboard, overwhelmed by numbers that feel more cryptic than helpful? Yeah, us too. What if I told you there’s a way to decode this chaos and turn data into dollars?

In this guide, we’ll demystify how combining personal finance tools with marketing automation can supercharge your analytics game. By the end of this post, you’ll understand why mastering Analytics Success isn’t just a “nice-to-have” skill—it’s essential.

Table of Contents

- Why Analytics Success Matters

- The Chaos of Managing Financial Data Without Automation

- How to Achieve Analytics Success Using Automation Tools

- Top Tips for Mastering Analytics Success

- Real-Life Example: From Data Disaster to Profit Peaks

- Frequently Asked Questions About Analytics Success

- Final Thoughts: Your Path to Analytics Success

Key Takeaways

- Personal finance apps integrated with marketing automation streamline decision-making.

- Data-driven insights save time and increase ROI in campaigns.

- Mistakes like ignoring key metrics are easy pitfalls—but avoidable!

Why Analytics Success Matters for Personal Finance

Let’s face it: the world of personal finance has gone digital. Whether you’re tracking expenses, budgeting, or analyzing investment portfolios, every action generates data. But here’s the kicker—without proper analytics, all those numbers might as well be buried treasure without a map.

Imagine spending hours collecting data only to realize it doesn’t tell you anything actionable. Sounds familiar? That’s where Analytics Success steps in—as your trusty pirate map guiding you toward smarter decisions.

The Chaos of Managing Financial Data Without Automation

I once tried managing my entire monthly expense sheet manually (yes, spreadsheets—I was young and reckless). It took FOREVER, and guess what? I still missed spotting an $80 subscription fee sneaking under radar for months. Talk about a “facepalm” moment.

This is the reality many people face when handling their finances without modern tools. Here’s why relying on outdated methods backfires:

- Time-sucking manual processes: Like watching water boil while waiting for formulas to calculate.

- Error-prone workflows: One typo could cost hundreds—or worse, thousands!

Grumpy You:* Ugh, who even HAS energy for this anymore?

Optimist You:* Hold up though; marketing automation tools exist for EXACTLY these pain points.

How to Achieve Analytics Success Using Automation Tools

If you’re ready to trade chaos for clarity, let’s break down exactly how you can achieve Analytics Success.

Step 1: Choose the Right Tool for Automation

Not all marketing automation platforms play nicely together with personal finance tools. Look for software solutions specifically built around financial management—think apps like Mint, PocketGuard, or YNAB paired with CRM systems such as HubSpot or Salesforce. These integrations ensure seamless syncing and analysis across platforms.

Step 2: Set Up Key Metrics Tracking

Don’t just collect random stats because they sound cool. Focus instead on KPIs relevant to your goals:

- Budget variance reports

- Savings rate vs. income growth

- Cash flow projections

Step 3: Automate Reporting and Alerts

No one wants daily emails cluttering their inbox unless they actually serve a purpose. Instead, schedule automated weekly reports highlighting trends, anomalies, and opportunities. Need urgent alerts? Configure notifications for critical thresholds (e.g., overspending limits).

Top Tips for Mastering Analytics Success

- Integrate Multiple Data Sources: Don’t limit yourself to one app; combine bank accounts, investments, and subscriptions into a unified view.

- Analyze Regularly: Consistency beats cramming quarterly reviews into panicked sprints.

- Stay Updated on Trends: New tools emerge constantly. Sticking to decade-old tech means falling behind competitors.

Real-Life Example: From Data Disaster to Profit Peaks

Meet Sarah—a freelance marketer drowning in spreadsheets trying to balance her business books. After integrating QuickBooks with ActiveCampaign, she gained real-time visibility into cash flow patterns and client profitability. Within six months, her earnings skyrocketed by 27%, thanks largely to automating repetitive tasks and focusing on high-ROI clients based on analytics insights. Talk about chef’s kiss!

Frequently Asked Questions About Analytics Success

Q: How do I know which metrics matter most?

A: Start with foundational ones tied directly to your primary goal (saving money, reducing debt, etc.). Build from there.

Q: Can small businesses use these strategies?

A: Absolutely. Small-scale operations benefit even more since efficiency equals survival in tight margins.

Q: Are free versions of apps enough?

A: Free tiers offer basic functionality but scaling requires premium features. Treat it like gym memberships—you get out what you put in!

Final Thoughts: Your Path to Analytics Success

To wrap things up, achieving Analytics Success isn’t some mystical art form meant for Silicon Valley elites. With the right combination of smart financial tools, robust marketing automation courses, and a dash of discipline, anyone can transform raw data into actionable wisdom.

Remember our friend Sarah? Her story proves that investing in education AND technology pays dividends. So whether it’s streamlining expenses or boosting campaign performance, make sure to prioritize analytics mastery.

Like a Tamagotchi, your SEO needs daily care—so nurture those insights until they grow strong roots. 😉