“Ever tried to automate your budget only to end up with more bills than savings?” If this hits a little *too close*, you’re not alone. Personal finance tools can transform your financial life, but mastering them? That’s where it gets tricky. Today, we’ll show you how software tutorials can turn you into a pro at navigating those cutting-edge financial apps—without losing sleep (or your wallet).

What You’ll Get from This Post

- A breakdown of why financial tools are essential.

- Actionable steps to learn these tools through software tutorials.

- Bonus tips and real-world examples so you don’t fall short like I did when I first started.

Table of Contents

- Key Takeaways

- Why Financial Tools Matter

- Step-by-Step Guide to Learning Software Tutorials

- Tips & Best Practices for Using Financial Apps

- Real-World Examples of Success Stories

- FAQs About Software Tutorials and Financial Tools

Key Takeaways

- Use software tutorials to make sense of complicated financial tools.

- Pick platforms tailored to your skills—no need to go full coding geek unless you want to!

- Consistency is key; practice regularly, or risk losing progress (just like an abandoned Tamagotchi).

Why Should You Care About Financial Tools?

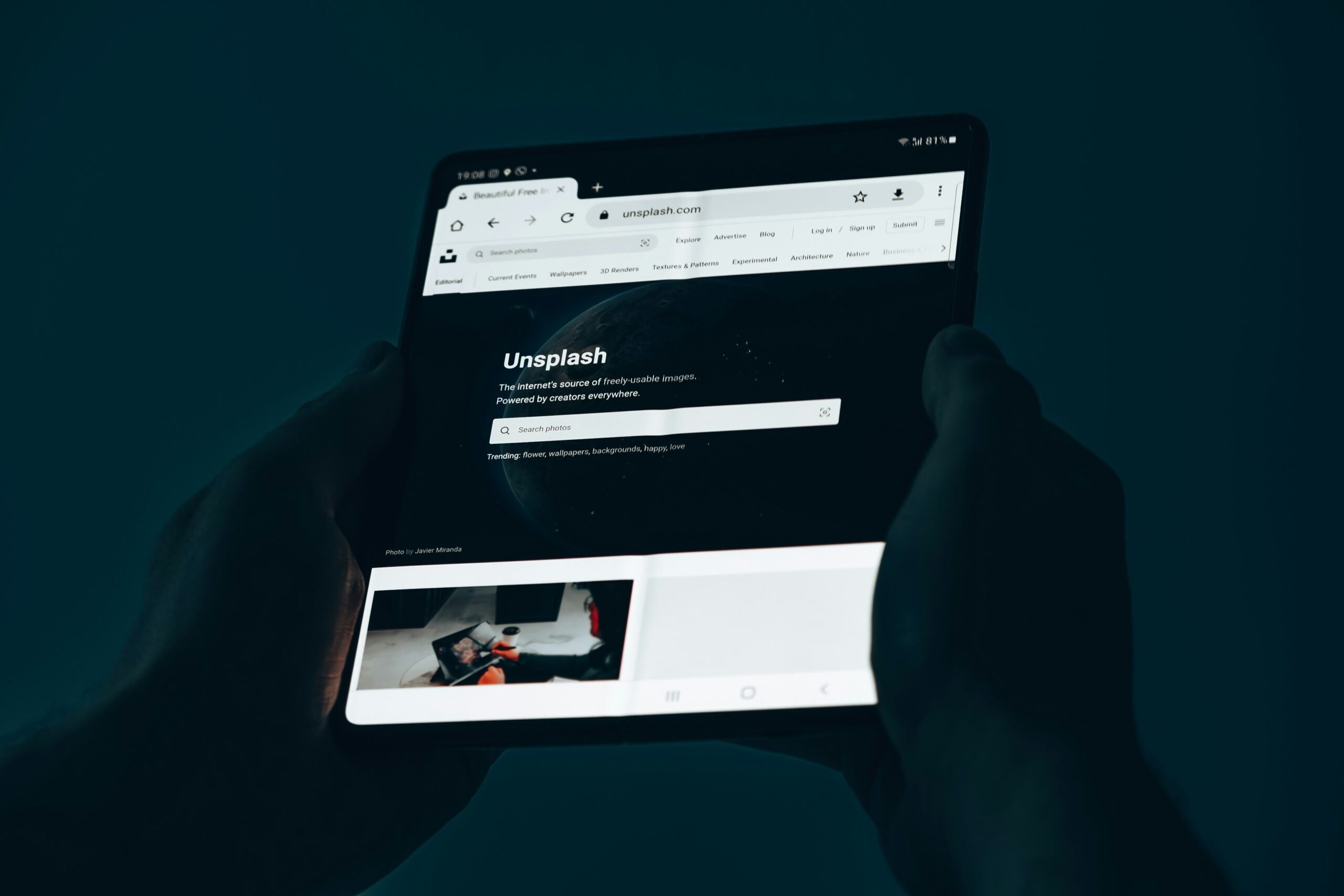

If you’ve ever felt overwhelmed by spreadsheets, receipts, and forgotten subscriptions, welcome to 2024—the era where “set it and forget it” isn’t just for crockpots anymore. From Mint to YNAB (You Need A Budget), automation has taken over personal finance management. These apps aren’t luxuries—they’re necessities if you want to stop wondering why you have $12 left before payday.

I made the mistake once: spending hours linking my bank account to some random app because “it looked cool,” then forgetting about it entirely (true story). Lesson learned—these tools require intentionality. And that’s where software tutorials save the day.

Software tutorials act as your digital sherpa, guiding beginners and experts alike through every curveball modern tech throws their way.

Step-by-Step Guide to Learning Software Tutorials

Step 1: Identify Your Weaknesses

Are you struggling with tracking expenses? Can’t figure out tax calculators? Be honest here—your weaknesses dictate what kind of tutorials will help most.

Step 2: Choose Beginner-Friendly Platforms

Forget jumping straight into advanced courses until you know the difference between credit utilization and interest rates! Start simple:

- Coursera: Offers structured lessons designed even for total newbies.

- YouTube: Free tutorials galore. Just search “software tutorials + [tool name].”

Step 3: Create a Study Schedule

No one learns everything overnight—not even Elon Musk. Block off 20 minutes daily on your planner dedicated solely to learning how to use specific features within each tool.

Grumpy Optimist Moment:

(Optimist You): “Consistent effort creates champions!”

(Grumpy You): “Cool, but am I getting paid for this?”

Tips & Best Practices for Using Financial Apps Like a Pro

Tip 1: Start Simple Before Scaling Up

Don’t dive into complicated algorithms right away. Focus on core functionalities first—like understanding dashboards or setting recurring reminders.

Tip 2: Avoid Overloading Yourself

Terrible Tip Alert: Don’t download five different apps simultaneously thinking you’ll conquer all. Spoiler—you won’t.

Tip 3: Automate What You Can

Ditch manual entries wherever possible. Let AI do its job while you sip coffee.

This strategy is chef’s kiss for drowning unnecessary stress,

says no sane person ever who tried juggling Excel files during tax season.

Real-World Examples of Success

Meet Sarah—a former freelancer drowning in late payments and disorganized invoices. She decided enough was enough and enrolled in a beginner-friendly Udemy course focusing on QuickBooks. Within months, she went from chaos queen to financial guru thanks to targeted software tutorials paired with her natural hustle.

FAQs About Software Tutorials and Financial Tools

How Long Does It Take to Learn New Financial Tools?

Depends on complexity. Basic tools take 2-3 weeks of casual study; complex ones might demand a month or two.

Do I Need Prior Tech Knowledge?

Not necessarily! Most tutorials assume zero prior knowledge. However having basic computer literacy helps immensely.

Can YouTube Replace Paid Courses?

Absolutely, IF you know exactly what to look for. Otherwise, structured platforms provide better guidance without rabbit holes.

In Conclusion…

Remember, nobody becomes a wizard overnight. By investing in the right software tutorials and leveraging top-notch financial tools, anyone can level up their personal finance game significantly. Now grab another cup o’ joe and start mastering those apps!

And hey…like rebooting Windows XP after installing too many programs, keep revisiting this guide whenever things feel overwhelming. 😉

“Finance ninjas rise / With just a few clicks unlocked / Dreams funded finally.”